Inflation: A Concern for All of Us

June 24, 2021 |Lawrence L. McCooey

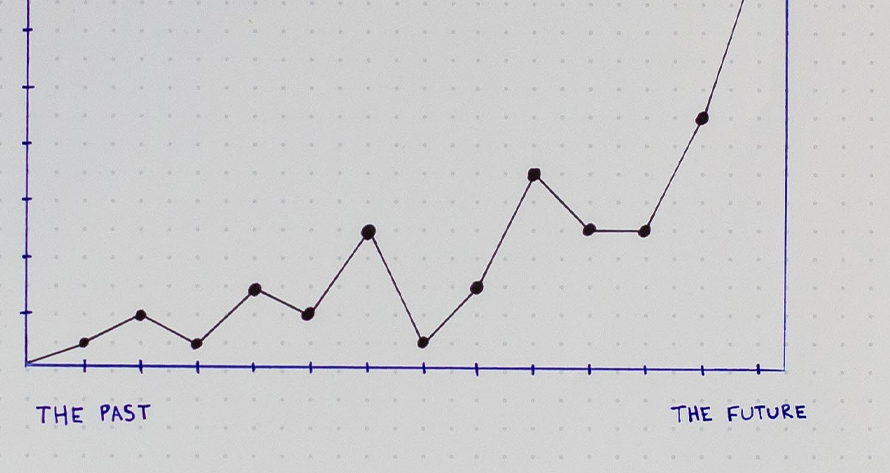

The recent reappearance of long-dormant inflation is a concern for all of us, as it strains our budgets, affects the financial markets, and erodes our purchasing power. So, you may be wondering, what is the outlook?

Federal Reserve Chairman Jerome Powell recently said, “You see extremely strong demand for labor, for goods, for services, and you’re seeing the supply side a little flat-footed trying to catch up.” But, he continued, “as these transitory supply effects abate, inflation is expected to drop back toward our longer-run goal.”

PIMCO, one of the world’s largest investment management firms and one of Orchard Alliance’s reserve fund managers, addressed the issue in a recent paper. In the “Inflation: a spike but not a spiral” section, the authors explained some of the reasons for their expectation that inflation will peak in the coming months. These included supply constraints in semiconductors, which has hindered the production of new cars, and logistical bottlenecks like shipping port congestion and the lack of truck drivers, which have increased costs that are passed on to consumers. Those conditions are expected to ease next year, and along with peaking goods demand, should moderate inflation over the rest of 2021.

PIMCO also stated that today’s high unemployment rate (at 5.8 percent) and improving productivity growth should minimize the risk of spiraling inflation. The authors concluded with this prediction: “For the U.S., we expect the year-over-year rate of core inflation to peak in the second quarter of 2021 around 4 percent, and end the year at 3.5 percent, before moderating back to 2.3 percent in 2022.”

We are glad to share timely information from some of our outstanding partners like PIMCO to help you in your stewardship journey. Orchard Alliance is here to equip you for greater Kingdom impact and to provide tools and resources along the way.

Please let me know if you have comments at presidentscorner@orchardalliance.org. They are always welcome.