How to Prepare for a Church Building Project: Part 2 of 5

October 30, 2019 |David Graf

Begin Your Financial Preparations Today

Finances may be the biggest hurdle to overcome with a potential building project. Fortunately, you don’t need to have a specific project in mind to begin to conquer this challenge. Even if you are a decade away from building, there are important steps you can begin right away—steps that will set you up for future success.

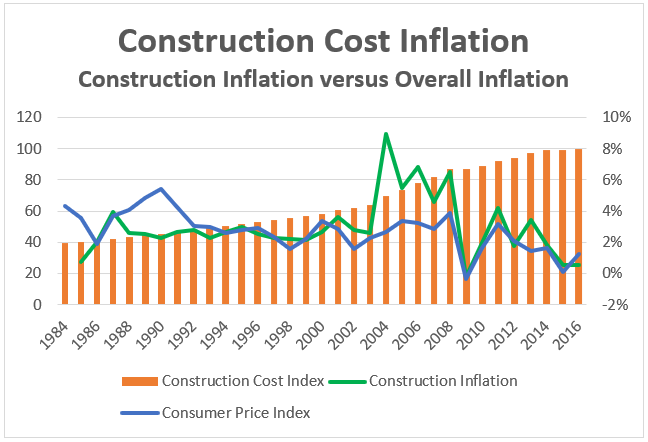

Regular increases in construction costs are not only tied to inflationary drivers such as labor and cost of materials but also to changes in building codes. Regardless of the reasons, construction is not getting any cheaper. So, how can your church prepare financially for a yet-to-be-defined future project? There are several ways.

Teach About Stewardship

Churches that teach stewardship regularly, not just during a time of special need, will be much better prepared for taking on a construction project than those that avoid the subject. If generosity is woven into your church’s culture long before a building project is proposed, it will be much less awkward to ask for special gifts when the greater need arises.

Start Saving Now

If you plan to borrow money, your lender will limit your borrowing to 70–80 percent of the completed project’s estimated value, including the land and any existing structures. While it’s possible that the land value may cover this requirement, it is unlikely. You will almost certainly be required to provide some cash. Make monthly saving a budget line-item. Take a percentage of your church’s income and set it aside into a savings account—and let your congregation know that you’re doing this. It will generate excitement and hope for the future.

Consider 100 Percent of Your Congregation’s Giving Power

Even if there is not a construction project in your future, your church should pursue non-cash forms of giving. Approximately 90 percent of the wealth in this country is not in cash or liquid assets—it’s in hard assets such as real estate. Yet most churches typically pursue donations from only the cash portion of their congregations’ wealth (the 10 percent). Our planned giving team at Orchard Alliance can help you encourage giving out of the larger resource.

Practice Making Loan Payments

Begin the discipline of making loan payments today. You can start with a very rough estimate of what you might borrow for a future building. For example, if you think you will need a 15,000 square-foot building, local commercial contractors or architects may tell you that construction costs are around $133 per square foot. If so, your building would cost $2 million, of which you could borrow up to 80 percent. You would need at least $400,000 cash on hand (or equity in the land and existing structures) by the time you’re ready to build in order to borrow the remaining $1.6 million. At an interest rate of 5 percent, your monthly payment for a 20-year amortized loan would be $10,559.

By the time you start construction, you should already be setting aside your estimated loan payment on a monthly basis. Don’t break ground without first proving to yourself that you can afford those payments. This will help your church to develop the discipline of saving money, especially if it will be several years before you’re ready to build.

Knowing that there is a plan to build in the future will create excitement within your congregation. It will prevent “budget shock” when it’s time to borrow, and it will keep you from committing money to current “felt needs” that may prevent you from affording the more important building solution down the road. Finally, it will give a potential lender confidence that you have set aside funds on a monthly basis similar to your future loan payment.

Implement Proper Accounting Practices

Regardless of your building plans, your church should take whatever steps necessary to ensure that proper accounting and strong financial management are in place. Utilize quality accounting software that produces good reports and ensure that you have a treasurer who understands accounting. This should be a priority even if it means hiring an accounting firm to keep your books and prepare reports. Without this, you will be making ministry decisions based on faulty information, and a lender will be less likely to make a loan.

Whenever you plan to build, begin your financial preparations today!

Click here to learn about Orchard Alliance’s lending programs.

David Graf

Vice President for Lending