Combatting the Secular Approach to Everything

October 31, 2023 |Scott Kubie

Our society is bent on exporting its secular approach to money and applying it to every aspect of our lives. Everything is something to be consumed. Consumerism used to apply to hot dogs, clothes, and furniture. Today, people approach less tangible experiences like love, with the same ethic. A single person can shop by scrolling pages of items on Amazon and then hop over to a dating app and do the same thing when trying to find romance. Is it any wonder people are off-kilter?

Worse, secular consumption is taking many Christians with it. Many consume a church service rather than center themselves on worship. If they aren’t happy, a church-shopping they will go. In a 2020 Barna study, Pastors listed a cultural shift to secularization as their number two concern. Pastors don’t believe their strategies are well-positioned to respond to the trend. Pastors rank poor discipleship models as their fourth concern. More worrisome, pastors believe the church has sought to Christianize materialism by embracing the prosperity gospel. (Fifth highest concern).

Combating the secular approach to everything starts by removing the impediments that rob Christians of financial joy. You can’t love both.

Orchard Alliance, in cooperation with the Ron Blue Institute and other collaborators, is seeking to push back against these trends. Our goal is to provide a financial discipleship model that allows stewards to experience greater joy. We have introduced a financial discipleship program that addresses the challenges more directly by answering the questions relevant to today’s questions. We emphasize three key approaches:

1. Discipleship over Download

Our default approach to most challenges is to educate the mind rather than disciple the soul. An informational approach to stewardship misses the spiritual and emotional battle. In Matthew 6:24, Jesus defines the battle by using verbs like serve, love, hate, devoted, and despise. Jesus’s words are loaded with emotional and spiritual power. Rather than download a bunch of information, people need a financial discipleship model that addresses spiritual temptations and draws people closer to Jesus. Combating the secular approach to everything starts by removing the impediments that rob Christians of financial joy. You can’t love both.

2. Principles over Prescription

People will make better decisions if they can bring core Biblical principles to their situation. We believe biblical financial principles have enduring value and provide excellent direction today. Some Christian financial experts tend to prescribe particular actions based on the biblical narrative without properly applying context. The biblical economic environment was based on agriculture. People became wealthy at others’ expense. (Zacchaeus) Today, the wealthy often derive their fortunes by serving people in an information economy. Biblical financial principles can help people avoid the temptations of consumerism.

3. Situations over Systematic

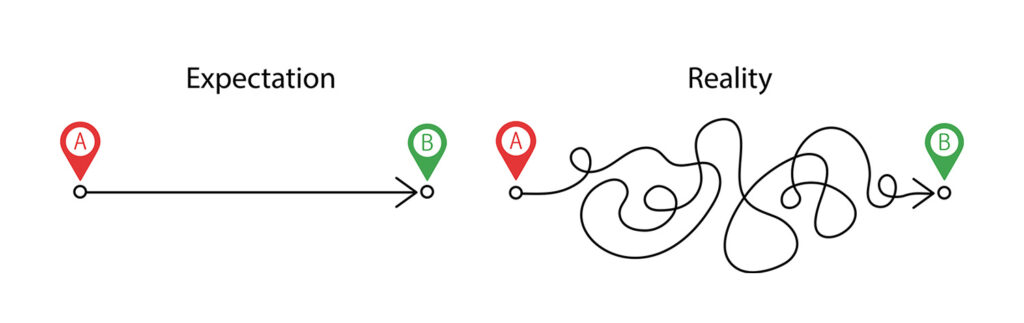

Financial discipleship needs to meet people where they are as they walk through life, not introduce them to a systematic theology of money that doesn’t help them live out their faith through daily choices. The systematic approach assumes stewards are made by moving along a short, direct path from point A to B. The indirect path is more realistic. Our discipleship programs need to provide support for the situations people face today. When I taught investments at the college level, people would lament the lack of financial education in high schools. Great sentiment! Terrible approach. High school students don’t care about mortgages, let alone retirement distribution strategies. They won’t remember anything they were taught. The same is true for financial discipleship. Even though the other path is longer and wanders, it is the one people walk. We need to walk with them for maximum impact.

Orchard Alliance is dedicated to serving The Alliance family where faith and finance meet. We’re excited to partner with the Ron Blue Institute to bring great small-group materials that provide a principle-based approach to financial discipleship. At recent district conferences, we’ve offered a free set of materials to any C&MA church. Our website, faithandfinance.org provides wisdom for specific situations and life stages.

These are early steps into a long-term ministry to strengthen the financial discipleship for the new and mature believer, for the successful and the struggling steward. We want people to thrive financially through wise choices and generous living. We are making these materials available to churches to push back against the materialism and secularism of the world and call people back to an approach to finances that contributes to a closer relationship with Jesus.

Scott Kubie, CFA

President